does tennessee have estate or inheritance tax

Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that. The inheritance tax is levied on an estate when a person passes away.

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

Technically Tennessee residents dont have to pay the inheritance tax.

. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. No Longer a Gift Tax in Tennessee.

Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. There are NO Tennessee Inheritance Tax.

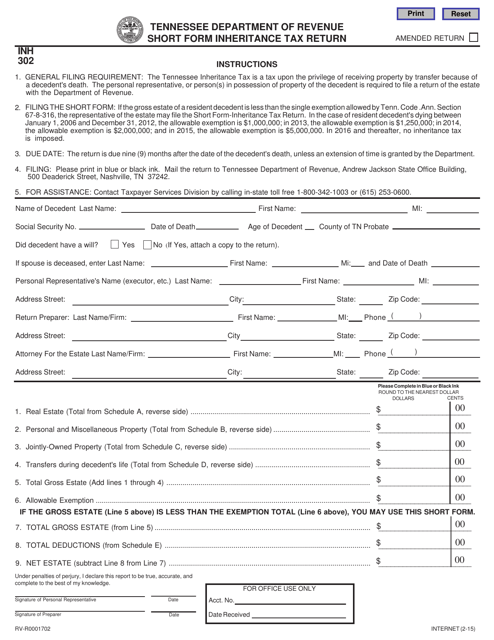

If the person passed away in 2015 and value of the decedents gross estate was below the exemption amount for 2015 an inheritance tax return INH 301 is not required but if the estate is probated it would need the short form inheritance tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Twelve states and the District of Columbia collect an estate tax at the state level as of 2019.

Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. Tennessee repealed its estate tax in 2016. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. Tennessee does not have an estate tax. Next year it will increase to 500000000 and then it will be abolished in 2016.

Even though this is good news its not really that surprising. Oklahoma and Kansas have also repealed their estate taxes. Estate and inheritance taxes have large compliance costs for states and they may become costlier if the estate tax is eliminated at the federal level as proposed in both the House GOP.

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. Inheritance Tax in Tennessee.

Maryland is the only state to impose both. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. For all deaths that occurred in 2016 and thereafter no Tennessee inheritance tax is imposed.

Final individual federal and state income tax returns. The inheritance tax is paid out of the estate by the executor administrator or trustee. The legislature set forth an exemption schedule for the tax with incremental increases for.

Since Tennessee does not have an estate tax you dont have much to worry about at the state level. Tennessee does not have an estate tax. New York raised its exemption level to 525 million this year and will match the federal exemption level by 2019.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The Federal estate tax only affects02 of Estates. But you still could get caught in the federal estate tax.

Impose estate taxes and six impose inheritance taxes. Tennessee is an inheritance tax-free state. For deaths occurring in 2016 or later you do not need to worry about Tennessee inheritance tax at all.

It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year. There are NO Tennessee Inheritance Tax. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

The following is a description of how the tax worked for deaths that occurred prior to 2016. It is one of 38 states with no estate tax. The inheritance and estate taxes wont be a concern of Tennessee residents who dont own or inherit the estate in other states or whose estate does not go anywhere around the lifetime exemption of 1206.

Only those estates that are valued 5 million or more are subject to the Tennessee estate tax. Up to 25 cash back Update. The Federal estate tax only affects02 of Estates.

Tennessee followed suit in 2016 and New Jersey and Delaware eliminated their estate taxes as of 2018. Tennessee is an inheritance tax and estate tax-free state. Each due by tax day of the year following the individuals death.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. The Federal inheritance tax exemption for 2014 was raised to 534000000 today. The inheritance tax is no longer imposed after December 31 2015.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Those who handle your estate following your death though do have some other tax returns to take care of such as. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015.

Some states have inheritance tax some have estate tax some have both some have none at all. Twelve states and Washington DC. See where your state shows up on the board.

Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000. Tennessee is not impose an estate tax. Federal estatetrust income tax return.

Indiana Ohio and North Carolina had estate taxes but they were repealed in 2013. All inheritance are exempt in the State of Tennessee. Some examples of tax returns involve final individual federal and state income tax returns federal estate income tax returns that are due by April 15 of the year following the persons.

It has no inheritance tax nor does it have a gift tax. Only seven states impose and inheritance tax. Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015.

However there are additional tax returns that heirs and survivors must resolve for their deceased family members. All inheritance are exempt in the State of Tennessee.

Tennessee Retirement Tax Friendliness Smartasset

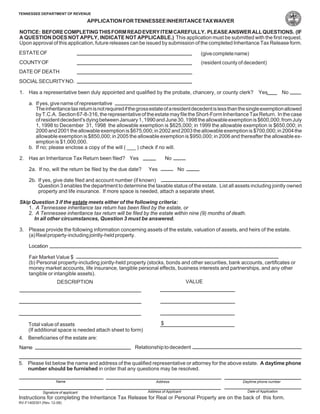

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

Tennessee Taxes Do Residents Pay Income Tax H R Block

A Guide To Tennessee Inheritance And Estate Taxes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Tennessee Estate Tax Everything You Need To Know Smartasset

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

Historical Tennessee Tax Policy Information Ballotpedia

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

State Estate And Inheritance Taxes Itep

Where S My State Refund Track Your Refund In Every State Taxact Blog

A Guide To Tennessee Inheritance And Estate Taxes

How Do State And Local Individual Income Taxes Work Tax Policy Center

Tennessee Estate Tax Everything You Need To Know Smartasset

What You Need To Know About Tennessee Will Laws